defer capital gains tax australia

This is the advantage of the deferred sales trust. Property and capital gains tax How CGT affects real estate including rental properties land.

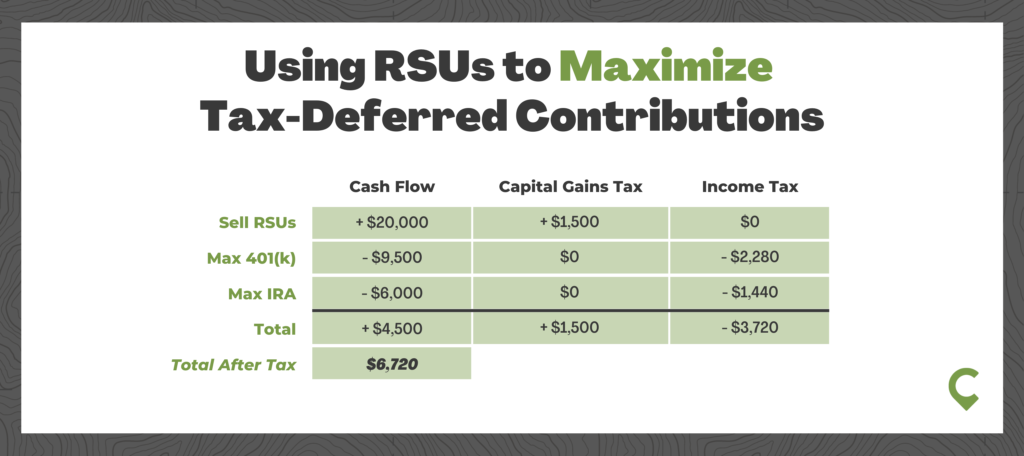

Rsu Taxes Explained 4 Tax Strategies For 2022

The small business capital gains tax CGT concessions allow you to reduce disregard or defer some or all of a capital gain from an active asset used in a small business.

. While self-managed super funds only attract a one-third discount for CGT the standard tax rate for funds is only 15 per cent meaning the maximum CGT rate is 10 per cent. A Tax-deferred rate will be determined for each financial year eg. As a rule if you want to roll over a capital gain.

Thus 15 of the original gain is tax-free. Can You Defer Capital Gains. If the funds are left in the QOF for at least seven years the basis increases again to 15 of the deferred capital gains.

You must make your choice by the date you lodge your tax return for the year in which the relevant CGT event happened the information you. Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange. How long do I need to live in a house to avoid capital gains tax.

The 1031 Exchange is the holy grail of tax deferral opportunities. If the funds remain. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the.

Defer capital gains tax australia. You purchased your rental property for 350000. At the moment the Australian Capital Gains Tax rate is 125 per cent and expats could be hit with it if they try to.

Your income is 75000 and your annual tax rate is 325. Defer capital gains tax australia Monday June 20 2022 Edit. Defer capital gains tax australia Thursday June 23 2022 Edit.

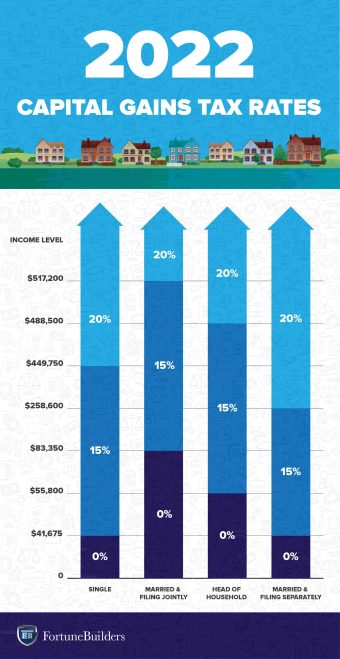

Tax-Deferred Exchange Many people refer to this arrangement as a tax-free exchange but capital gains are. Generally you disregard a capital gain or capital loss on. Under current law short-term capital gains are treated as ordinary income with a top tax rate of 408 370 plus 38 net investment income tax NIIT.

The deferral is in effect until the QOF investment is sold or exchanged or on Dec. If you made no capital gain in 202021 defer the capital loss until you make a capital gain. You sell the rental property for 600000.

Your expenses are 70000. Shares and similar investments Check if you are an investor or. Use the calculator or steps to work out your CGT including your capital proceeds and cost base.

Property and capital gains tax How CGT affects real estate including rental properties land improvements and your home. Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most. The investor is then exempt from income tax for that proportion of the income distributions they have.

It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales. Because the DST is recognized as an installment sale by IRS Section 453 the capital gains tax can be legally deferred. Use the calculator or steps to work out your CGT including your capital proceeds and cost base.

Rather it is deferred into another property. However the Tax Cut and Jobs Act TCJA which took effect on Jan. 31 2026 whichever comes first.

The practical effect of CGT event I1 is that a departing Australian taxpayer is subject to capital gains tax on an unrealised gain when the taxpayer is not likely to have. Disposal of your main residence if.

How To Avoid Capital Gains Tax When You Sell A Rental Property

How To Avoid Capital Gains Taxes Smartasset

How To Avoid Capital Gains Taxes Smartasset

What Is A 1031 Exchange Rules Requirements Process

How Do I Avoid Capital Gains Tax In Australia

Foreign Companies Expat Tax Professionals

How To Know If You Have To Pay Capital Gains Tax Experian

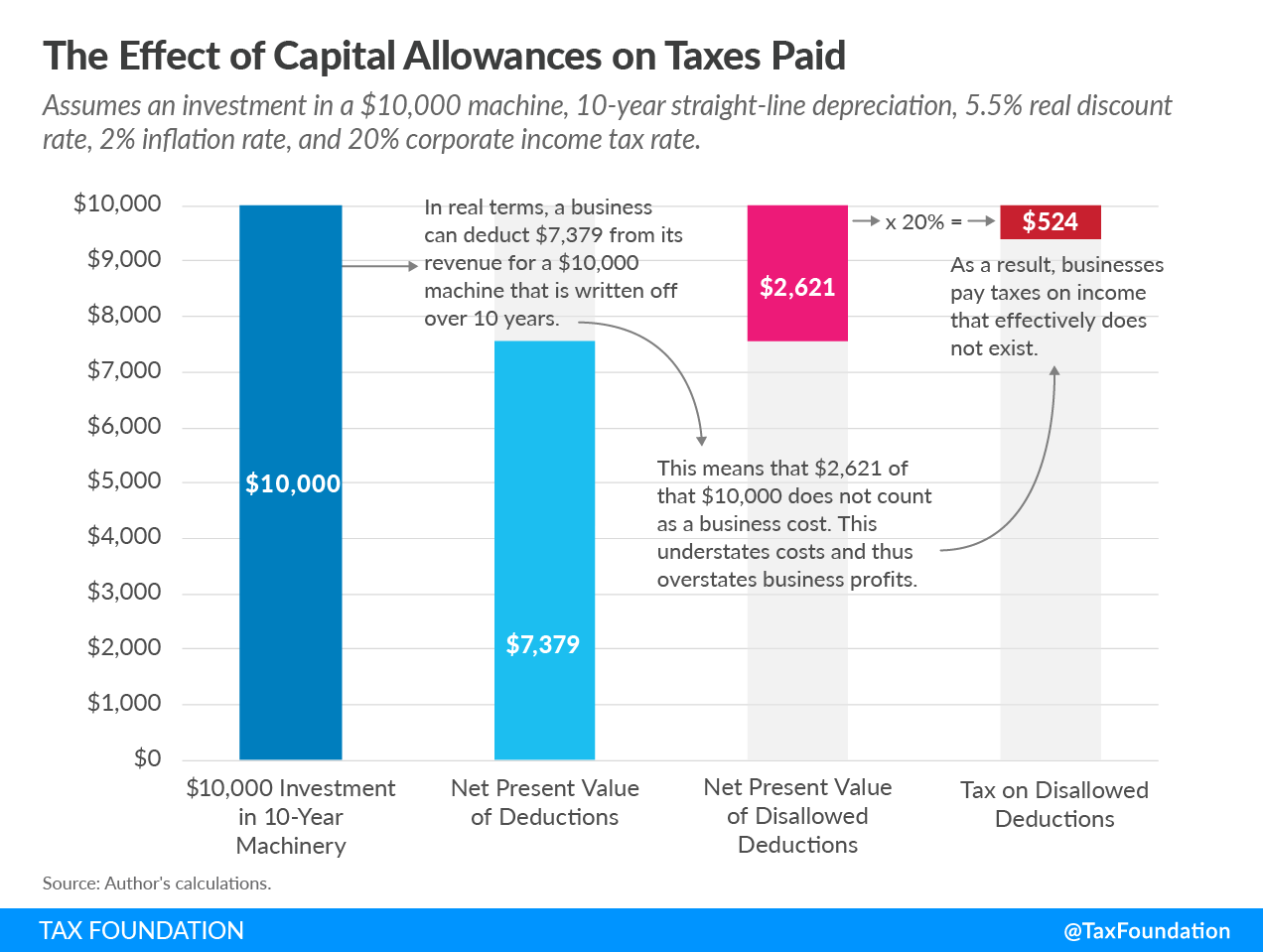

Capital Allowances Capital Cost Recovery 2021 Tax Foundation

Money Clip Protection Minimizing Your Exposure To Capital Gains Taxes

Bkr Employment Tax Practice Group Ppt Download

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Capital Gains Tax What Is It When Do You Pay It

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Know The Strategies When It Comes To Taxes On Options Ticker Tape

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

There Are Only Limited Opportunities To Defer Capital Gains Tax

6 Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales